Some payment processors, such as Dutchie, found a way to set up systems allowing customers to use debit cards with a personal identification number. You make a purchase with your debit card and the money goes directly to the cannabis company. Seems straightforward, right?

Well, not exactly.

As with many things concerning the cannabis industry, it’s not that simple. In late July, Mastercard put the brakes on U.S. financial institutions using its debit cards for marijuana, even when customers are buying weed in states where it’s legal. The company expressed concerns about remaining in compliance with federal banking laws, never mind that recreational weed is legal in 22 states and medical marijuana in 38.

Other forms of electronic payment, like “cashless ATMs” at dispensaries, have also been halted. Cashless ATMs allowed customers to purchase cannabis at dispensaries with their bank cards by reporting the payments as ATM withdrawals instead of purchases.

How will Mastercard’s decision impact the Valley?

In metro Phoenix, the impact of Mastercard's decision is mixed. Some dispensaries said that despite the kibosh on electronic payments, it’s business as usual for them. But others have had to scramble.“It was a big blow to the entire cannabis community,” said Raul Molina, the co-owner and COO of Mint Cannabis. “We’ll be going back to cash only and we’ll maintain that until the timing is right.”

The cannabis industry would like to move away from cash not only for convenience and increased sales but for safety and transparency. Handling large amounts of cash puts everyone at risk and makes accounting more difficult — and possibly murky.

Molina said for three years, Mint looked for a way to accept debit cards and finally went with Dutchie. In July 2022, Dutchie announced the launch of a closed-loop automatic clearing house bank transfer for cannabis purchases. In this system, money transfers from a customer’s bank account to the cannabis company’s bank account. In other words, it’s like the Zelle of cannabis.

But following Mastercard's announcement, Dutchie updated its user agreement and said it would use Bitcoin and a digital wallet for payments. The announcement caused Mint to reverse course.

The move by Mastercard was “a bummer,” Molina noted. Mint saw “a small jump in sales” when people could use debit cards since they weren't limited to spending just the cash they had on hand. Although most dispensaries have ATMs, users often pay a service fee to access their money.

Butch Williams, a board member of White Mountain Health Center, said the medical dispensary in Sun City keeps its ATM fees low, but it still impacts customers. “It is a burden for them to not just have the freedom to use their debit cards,” he said.

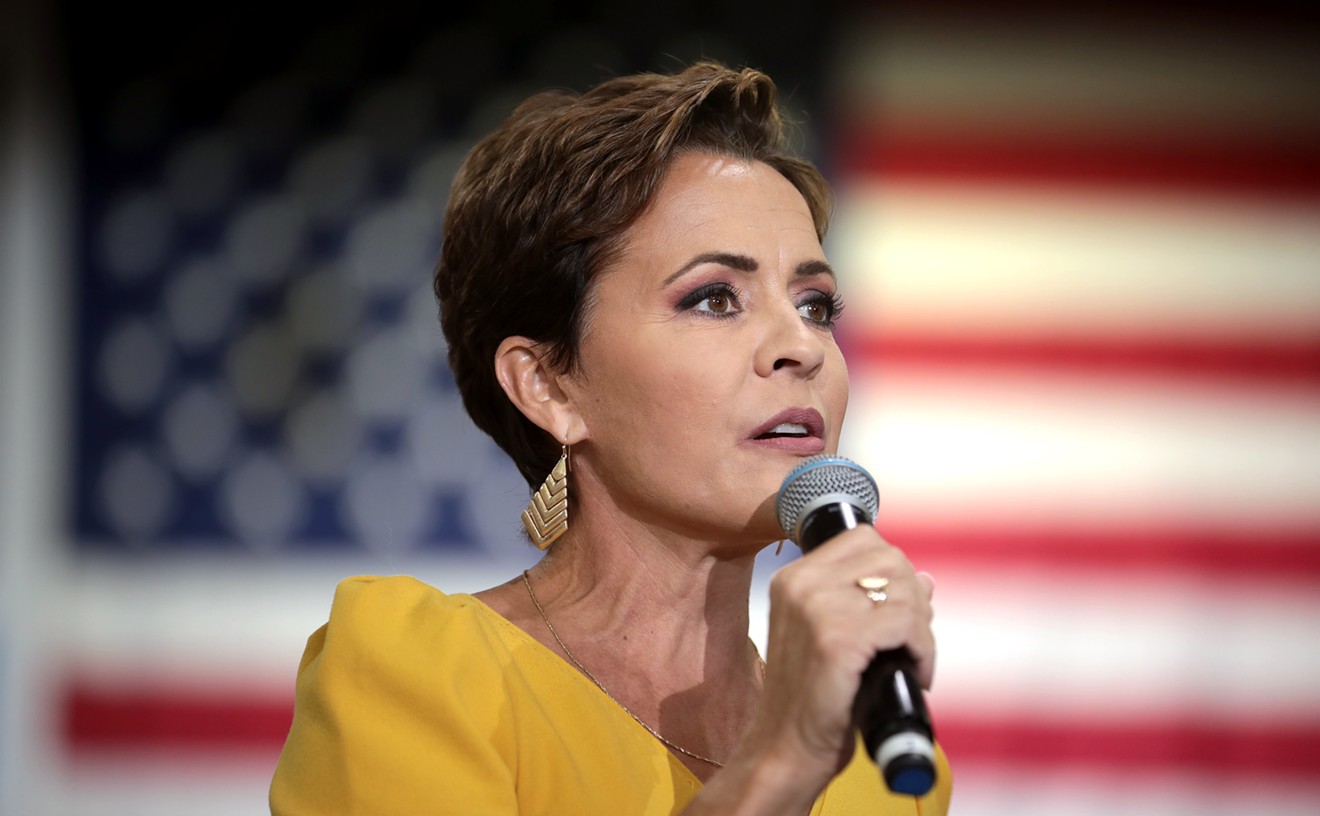

Aubrey Amatelli likened Silicon Valley-based PayRio to popular peer-to-peer payment apps and said it provides fully compliant proprietary technology for purchasing marijuana.

O'Hara Shipe

The next wave of cashless payment options

Aubrey Amatelli, founder and CEO of cannabis payment startup PayRio, said PIN debit options are still available for dispensaries. "The only payment processors that were shut down were the PIN debit processors that partnered with Mastercard," she said.Amatelli likens Silicon Valley-based PayRio to popular peer-to-peer payment apps and said it provides a fully compliant option with proprietary technology for purchasing marijuana. She said more than 100 dispensaries nationwide already use it.

“There are solutions like ours and other PIN debit solutions that are compliant,” Amatelli noted. “We’re happy to be launching with a few dispensaries in Arizona shortly.”

However, she said federal banking and drug laws need to change so cannabis companies aren’t made to jump through hoops for banking.

“I think the SAFE Banking Act is the first thing that needs to happen and then [federal cannabis legalization] will fall into place after,” Amatelli said. The SAFE legislation, which was reintroduced in Congress in April, would normalize banking services for state-licensed cannabis companies.

Demitri Downing, founder and president of the Marijuana Trade Association of Arizona, said the Mastercard decision was a reminder that acceptance of cannabis is growing but there's still work to do.

“It actually ties back to the fact that people need to remember that this is still federally illegal and work needs to be done to change that so we can have a functional, normal business environment,” Downing said. “Politicians don’t want to get involved in regulating it because they think they’re sort of condoning cannabis use when you regulate it, which is a horrible mistake.”

Ann Torrez, executive director of the Arizona Dispensaries Association, couldn’t say how many dispensaries would be affected by Mastercard’s decision but noted that it would have a ripple effect throughout the economy.

The lack of access to banking hurts growers and dispensaries, their customers and related businesses, such as advocacy groups like the ADA, marketing firms and vendors who supply or service cannabis companies, she explained. And there’s a limited number of small banks in the state that offer accounts to cannabis-related businesses.

Downing said less than five banks openly do it, though “others maybe don’t ask questions,” he said, or owners claim to be in “agriculture” or “wellness.”

Torrez said while decriminalizing marijuana would be “awesome,” for now, advocates are urging Congress to pass the SAFE Banking Act.

“Although cannabis is a growing industry, it’s not mainstream by any means,” she stated. “There are some banks that will participate in cannabis banking. But the industry could use more.”